KRA Launches USSD Service to Simplify Tax Access for All Kenyans. It allows taxpayers to access key services using basic mobile phones, without the need to visit KRA offices or online platforms

An undated image of customers lining up for services at KRA’s offices.

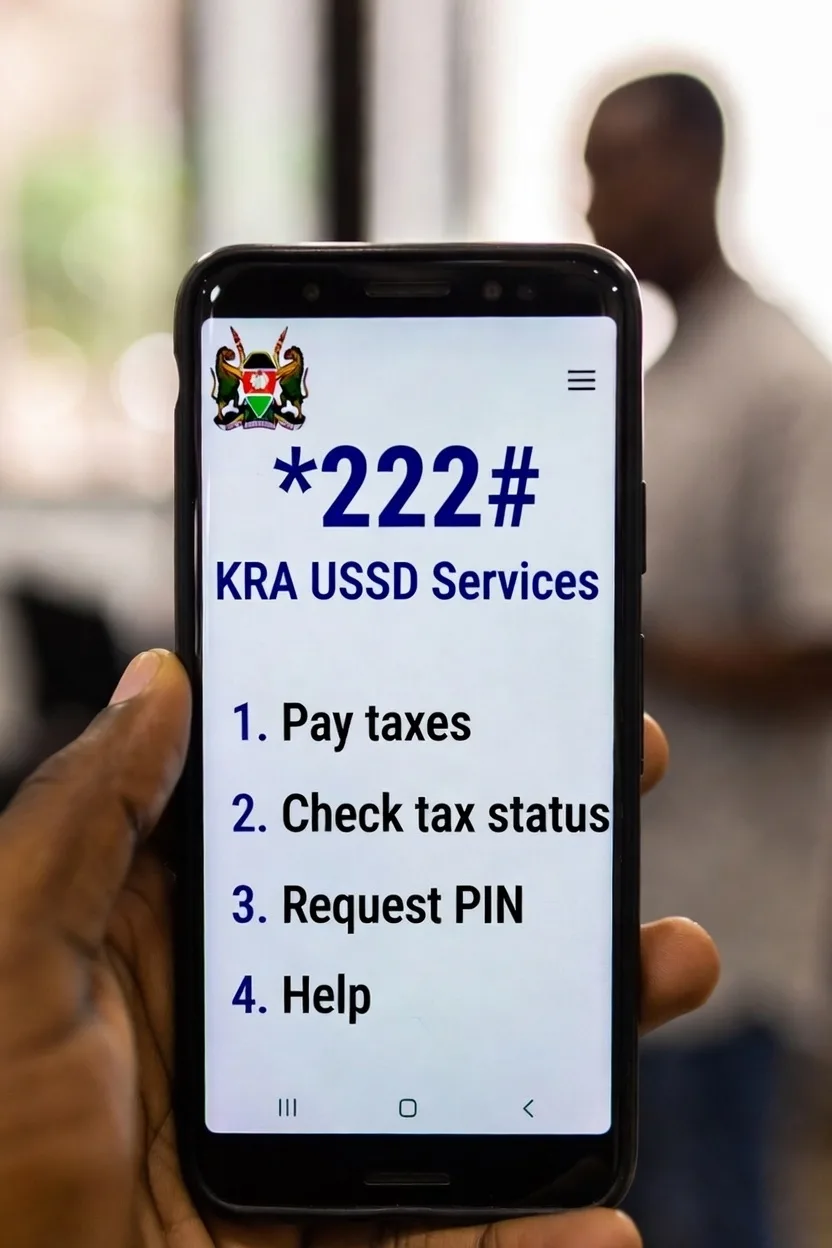

KRA Launches USSD Service to Simplify Tax Access for All Kenyans. Hey there, Fellow Kenyan, have you ever felt the frustration of long queues at KRA offices or the hassle of navigating online platforms just to handle your taxes? You’re not alone. But guess what? In a move designed to bridge the digital divide and make tax compliance easier for everyone, the Kenya Revenue Authority (KRA) has rolled out a new USSD service accessible via *222#. This initiative, as revealed by KRA, aims to empower taxpayers—especially those without smartphones or reliable internet—to handle essential services right from their basic mobile phones. No more long queues at KRA offices or struggling with online portals; this is about bringing convenience directly to your fingertips.

As we head into the 2026 tax filing season, this service couldn’t come at a better time. KRA acknowledges the challenges many face: “One of the most frequent concerns has been around digital access. We know that not every taxpayer has a smartphone, reliable internet, or even the digital expertise needed to use platforms like iTax or eTIMS,” the authority stated in their announcement. They’re committed to inclusivity, adding, “We hear you, and we are taking action. We are working to simplify our tools, provide offline support, and increase grassroots outreach, because no Kenyan should be left behind due to technology barriers.”

What Services Can You Access?

Dialling *222# and selecting Option 5 for KRA services opens up a world of possibilities. Here’s a breakdown of what’s available:

- PIN Registration and Recovery: New users can register for a KRA PIN, while existing ones can recover forgotten PINs or check their status—crucial steps for seamless tax filing.

- Turnover Tax (TOT) and Monthly Rental Income (MRI): Handle these obligations quickly without needing an app or computer.

- eTIMS and Payments: Manage electronic Tax Invoice Management System tasks and make payments on the go.

- Tax Compliance Certificates (TCC): Apply for or check your TCC, which is often required for business dealings.

- Customs and Other Tax Returns: Deal with customs-related queries and file various other returns effortlessly.

This USSD platform is particularly valuable for rural dwellers, small business owners, or anyone with limited tech access. Imagine a farmer in the Rift Valley checking their PIN or filing a simple return without traveling to the nearest KRA office—it’s a game-changer for efficiency and compliance.

TAXES CAN BE DIFFICULT

Let our experts handle it while you focus on what matters most

Reducing Barriers to Tax Compliance

KRA’s introduction of this service directly addresses longstanding issues that have hindered tax adherence. Physical visits to offices, like those at Samia Park in Nairobi, have often been a deterrent due to time, cost, and inconvenience. By minimizing these trips, KRA hopes to boost voluntary compliance and reduce the administrative burden on both taxpayers and the authority.

This isn’t just talk; it’s part of a broader strategy. Just two months ago, on November 7, 2025, KRA announced plans to validate income and expenses declared in tax returns starting with the 2025 filings. Using data from sources like TIMS/eTIMS invoices, Withholding Income Tax records, and customs import data, the authority will cross-check submissions upon filing via iTax—due by June 2026. “This validation will take place upon submission of the 2025 year of income/accounting period via the iTax platform,” KRA noted.

For those who’ve delayed filings, there’s good news too: KRA has removed penalties for returns filed during an extended period, encouraging more people to get up to date without fear of fines.

We’re here to guide you.

You don’t have to navigate it alone

Why This Matters to You

As a Kenyan taxpayer, this USSD service feels like a personal win. Whether you’re a salaried employee juggling deadlines or a landlord managing rental income, having these tools at *222# means less stress and more control over your finances. It’s a reminder that government services are evolving to meet us where we are, not forcing us to adapt to complex systems.

If you’re yet to try it, grab your phone and dial *222# today. Select Option 5, and explore how it can simplify your tax life. For more details, visit KRA’s official channels or check out updates on platforms like https://www.kenyans.co.ke. Staying compliant has never been this straightforward—let’s make the most of it for a smoother 2026 tax season.

GET IN TOUCH

Leave a Reply